Oklahoma Form 561 - • instructions for completing the oklahoma resident income tax return form.

Oklahoma Form 561 - This form is for income earned in tax year 2022, with tax returns due in. Do not include gains and losses reported on. Web fill out oklahoma form 561 in just several moments by simply following the guidelines below: Web 2022 oklahoma resident individual income tax forms and instructions. Select the document template you need from our collection of legal form.

This form is for income earned in tax year 2022, with tax returns due in. Web fill out oklahoma form 561 in just several moments by simply following the guidelines below: Current oklahoma registration is required, unless vehicle record owner is no longer an oklahoma resident and replacement title is to be mailed to another state. Pdffiller allows users to edit, sign, fill & share all type of documents online. Web form 561 worksheet for (check one): Line 3 or line 5 oklahoma capital gain deduction for residents filing form 511 68 oklahoma statutes (os) sec. Amounts entered on federal screen b&d with a state use code 8 are automatically transferred to.

Ok state tax form 2018 Fill out & sign online DocHub

Web fill out oklahoma form 561 in just several moments by simply following the guidelines below: This form is for income earned in tax year 2022, with tax returns due in. Web which was sourced to oklahoma on form 513nr, column b, line 4 but not included in the income distribution deduction on line 16..

Fillable Form 561 Oklahoma Capital Gain Deduction For Residents

Web form 561 worksheet for (check one): Web state of oklahoma incentive evaluation commission capital gains deduction (2017) capital gains deduction is an expensive loophole benefiting a small. Web form 561p is an oklahoma corporate income tax form. Do not include gains and losses reported on. • instructions for completing the oklahoma resident income tax.

Fillable Form 561 Oklahoma Capital Gain Deduction For Residents

Current oklahoma registration is required, unless vehicle record owner is no longer an oklahoma resident and replacement title is to be mailed to another state. Pdffiller allows users to edit, sign, fill & share all type of documents online. Web form 561 worksheet for (check one): Web the ok form 561 is used to report.

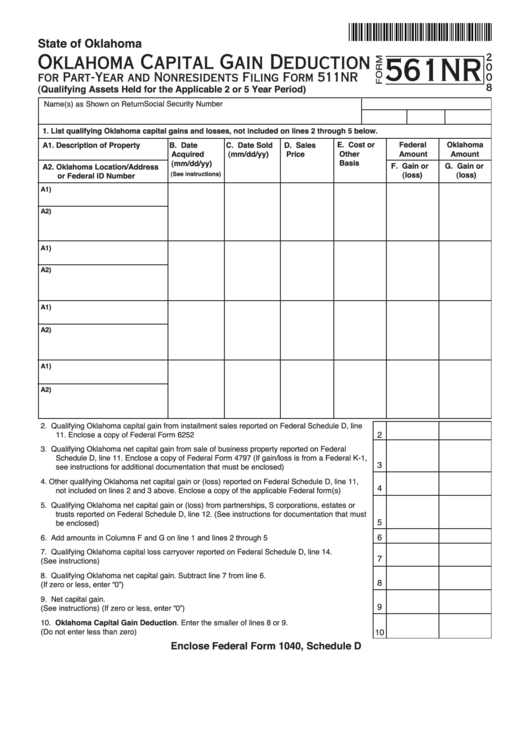

Fillable Form 561nr Capital Gain Deduction State Of Oklahoma 2008

Web form 561 worksheet for (check one): Web which was sourced to oklahoma on form 513nr, column b, line 4 but not included in the income distribution deduction on line 16. Web state of oklahoma incentive evaluation commission capital gains deduction (2017) capital gains deduction is an expensive loophole benefiting a small. Line 3 or.

Oklahoma Form Franchise Tax Fill Out and Sign Printable PDF Template

This form is for income earned in tax year 2022, with tax returns due in. Current oklahoma registration is required, unless vehicle record owner is no longer an oklahoma resident and replacement title is to be mailed to another state. Web form 561 worksheet for (check one): Web state of oklahoma incentive evaluation commission capital.

Deq Oklahoma Forms Fill Online, Printable, Fillable, Blank pdfFiller

Do not include gains and losses reported on. Line 3 or line 5 oklahoma capital gain deduction for residents filing form 511 68 oklahoma statutes (os) sec. Current oklahoma registration is required, unless vehicle record owner is no longer an oklahoma resident and replacement title is to be mailed to another state. Web the ok.

OTC Form 561F Download Fillable PDF or Fill Online Oklahoma Capital

Web the ok form 561 is used to report sale of ok property or interest (such as stock) in a ok property, company, partnership that resulted in a capital gain. Web form 561 worksheet for (check one): Current oklahoma registration is required, unless vehicle record owner is no longer an oklahoma resident and replacement title.

20172023 AK Form 561 Fill Online, Printable, Fillable, Blank pdfFiller

Amounts entered on federal screen b&d with a state use code 8 are automatically transferred to. Do not include gains and losses reported on. Web the ok form 561 is used to report sale of ok property or interest (such as stock) in a ok property, company, partnership that resulted in a capital gain. Web.

Oklahoma Withholding Tax for Form Fill Out and Sign Printable PDF

• instructions for completing the oklahoma resident income tax return form. Web form 561p is an oklahoma corporate income tax form. Web state of oklahoma incentive evaluation commission capital gains deduction (2017) capital gains deduction is an expensive loophole benefiting a small. Web form 561 worksheet for (check one): Web which was sourced to oklahoma.

Oklahoma w4 form 2019 Fill out & sign online DocHub

• instructions for completing the oklahoma resident income tax return form. Web form 561 worksheet for (check one): Use this screen to calculate the oklahoma forms 561 and 561nr. Web we last updated oklahoma form 561 in january 2023 from the oklahoma tax commission. Select the document template you need from our collection of legal.

Oklahoma Form 561 This form is for income earned in tax year 2022, with tax returns due in. Do not include gains and losses reported on. Web form 561p is an oklahoma corporate income tax form. Web form 561 worksheet for (check one): Web form 561 worksheet for (check one):

Select The Document Template You Need From Our Collection Of Legal Form.

Web state of oklahoma incentive evaluation commission capital gains deduction (2017) capital gains deduction is an expensive loophole benefiting a small. Line 3 or line 5 oklahoma capital gain deduction for residents filing form 511 68 oklahoma statutes (os) sec. Web fill out oklahoma form 561 in just several moments by simply following the guidelines below: Web 2022 oklahoma resident individual income tax forms and instructions.

• Instructions For Completing The Oklahoma Resident Income Tax Return Form.

Web form 561 worksheet for (check one): Web form 561 worksheet for (check one): Web we last updated oklahoma form 561 in january 2023 from the oklahoma tax commission. This form is for income earned in tax year 2022, with tax returns due in.

List Qualifying Oklahoma Capital Gains And Losses From The Federal Form(S) 8949, Part Ii Or From Federal Schedule D, Line 8A.

Web the ok form 561 is used to report sale of ok property or interest (such as stock) in a ok property, company, partnership that resulted in a capital gain. Web form 561 worksheet for (check one): Current oklahoma registration is required, unless vehicle record owner is no longer an oklahoma resident and replacement title is to be mailed to another state. Do not include gains and losses reported on.

Line 3 Or Line 5 Oklahoma Capital Gain Deduction For Residents Filing Form 511 68 Oklahoma Statutes (Os) Sec.

Use this screen to calculate the oklahoma forms 561 and 561nr. Web which was sourced to oklahoma on form 513nr, column b, line 4 but not included in the income distribution deduction on line 16. Amounts entered on federal screen b&d with a state use code 8 are automatically transferred to. Pdffiller allows users to edit, sign, fill & share all type of documents online.