Montana Property Tax Rebate Form - Web check the status of your property tax rebate.

Montana Property Tax Rebate Form - Dor communicates rebate information at. The department says taxpayers can apply for the 2022 property tax rebates through its online transaction portal or via a paper form during an application period that runs from aug. Claims must be filed by october 1, 2023. Deadline to claim montana property tax rebate worth up. Please join us for property assessment division.

Web the department says taxpayers can apply for the 2022 property tax rebates through its online transaction portal or via a paper form during an application period that runs from aug. Web the property tax rebate claim period has closed. Learn about the individual income tax rebate. Web beginning august 15, eligible montana homeowners may claim their property tax rebate up to $675 at getmyrebate.mt.gov. (a) $500 or the amount of total property taxes paid, whichever is less, for tax year 2022; Web what do i have to do to get the property tax rebates? Claim for the 2023 property tax rebate during calendar year 2024.

lasopacleveland Blog

Web montana property tax rebate. According to the department, claims made electronically through its website must be filed by 11:59. (a) $500 or the amount of total property taxes paid, whichever is less, for tax year 2022; Department rulemaking activity for september 8, 2023; Deadline to claim montana property tax rebate worth up. Download the.

Form Fid Montana Estate Or Trust Tax Payment printable pdf download

Claim for the 2023 property tax rebate during calendar year 2024. Web the property tax rebate claim period has closed. Claims must be filed by october 1, 2023. There are rebates available for property taxes paid for both the 2022 and 2023 tax years. Web last call to claim property tax relief; Beginning august 15,.

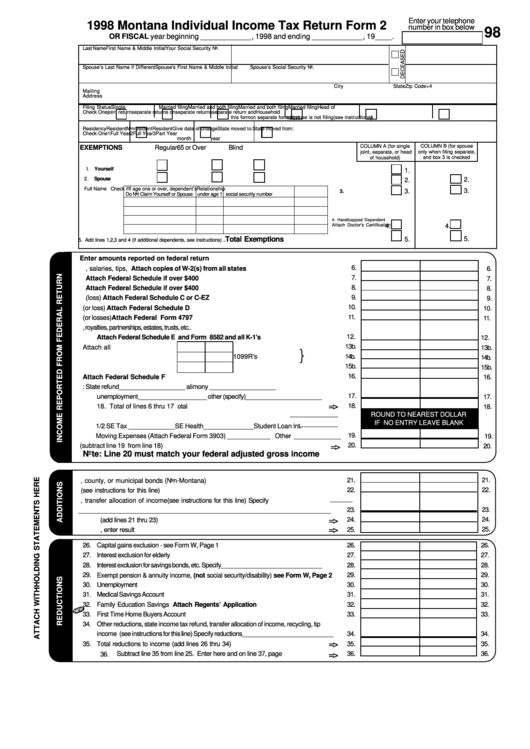

Fillable Form 2 Montana Individual Tax Return 1998 printable

Greg gianforte is not among the more than 43,000 eligible property owners who qualified for a state property tax rebate but did not receive one. 2022 claims must be filed by october 1, 2023. Web montana property tax rebate. According to a public documents, gianforte and his wife, montana first lady susan gianforte, filed for.

Fillable Homeowner Property Tax Refund Form Montana Department Of

Beginning august 15, 2023, taxpayers may claim their 2022 rebate online at getmyrebate.mt.gov or by paper form. These you have to apply for. Web what do i have to do to get the property tax rebates? Web montana homeowners have through this coming monday, oct. The department says taxpayers can apply for the 2022 property.

Form INH4 Download Printable PDF or Fill Online Application for

Beginning august 15, 2023, taxpayers may claim their 2022 rebate online at getmyrebate.mt.gov or by paper form. The department accepted online claims until 11:59pm on october 2, 2023 and will accept paper claims postmarked by october 2, 2023. (a) $500 or the amount of total property taxes paid, whichever is less, for tax year 2022;.

Fillable FormFid Montana Estate Or Trust Tax Payment Voucher

We will be updating this page as new information becomes available. The last day to claim the montana property tax rebate is monday, october 2. The qualifications to claim the rebate are available at getmyrebate.mt.gov. For those whose filing status was single, head of household, or married filing separately, the rebate will be either $1,250.

Montana State Property Tax Rebate

Eligible homeowners can claim up to $675 in montana property tax rebate. Web the property tax rebate claim period has closed. Web governor's office august 14 2023 helena, mont. 2022 claims must be filed by october 1, 2023. Web what do i have to do to get the property tax rebates? Web the individual income.

Montana Personal Property Tax PROPERTY BSI

Web 3 paid property taxes on this residence. A second application period for 2023 rebates will be open across the same dates in 2024. Homeowners are eligible if they owned and. Web the property tax rebate claim period has closed. 2 — a figure that, mtfp calculates, represents about. The qualifications to claim the rebate.

Form MDV Download Fillable PDF or Fill Online Montana Disabled Veteran

This form is only valid for the 2022 property tax. Learn about the individual income tax rebate. These you have to apply for. Web property tax exemption application. 1 to claim a property tax rebate from the montana department of revenue at getmyrebate.mt.gov or through a paper form. Web montana homeowners have through this coming.

Property Tax Rebate Application printable pdf download

2022 claims must be filed by october 1, 2023. Claim for the 2023 property tax rebate during calendar year 2024. The last day to claim the montana property tax rebate is monday, october 2. Claims must be filed by october 1, 2023. Learn about the individual income tax rebate. Beginning august 15, 2023, taxpayers may.

Montana Property Tax Rebate Form How do i claim a property tax rebate? Montana's property tax rebate is a rebate of up to $675 a year of property taxes paid on a principal residence. Eligible homeowners can claim up to $675 in montana property tax rebate. Web the property tax rebate claim period has closed. Visit the department’s webpage devoted to the rebates to learn more and see if you qualify.

House Bill 192 — Use Surplus Revenue For Income Tax And Property Tax Refunds And Payment Of Bonds.

Learn about the individual income tax rebate. There are rebates available for property taxes paid for both the 2022 and 2023 tax years. Web the property tax rebate can be applied for either through the online portal set up by the state or by paper form. The qualifications to claim the rebate are at getmyrebate.mt.gov.

Eligible Homeowners Can Claim Up To $675 In Montana Property Tax Rebate.

Any person, firm, corporation, partnership, association, or other group who wants real or personal property qualified as tax exempt must submit an application to the department of revenue. Web montana homeowners have through this coming monday, oct. The qualifications to claim the rebate are available at getmyrebate.mt.gov. Web fri, march 24th 2023, 5:40 am pdt (photo:

Property Tax Rebates Reach Halfway Point;

The department accepted online claims until 11:59pm on october 2, 2023 and will accept paper claims postmarked by october 2, 2023. Homeowners are eligible if they owned and. The department accepted online claims until 11:59pm on october 2, 2023 and will accept paper claims postmarked by october 2, 2023. Beginning august 15, 2023, taxpayers may claim their 2022 rebate online at getmyrebate.mt.gov or by paper form.

Web Last Call To Claim Property Tax Relief;

The fastest way for taxpayers to apply for and get the rebate is by applying online. Web property tax exemption application. Web 3 paid property taxes on this residence. How do i claim a property tax rebate?