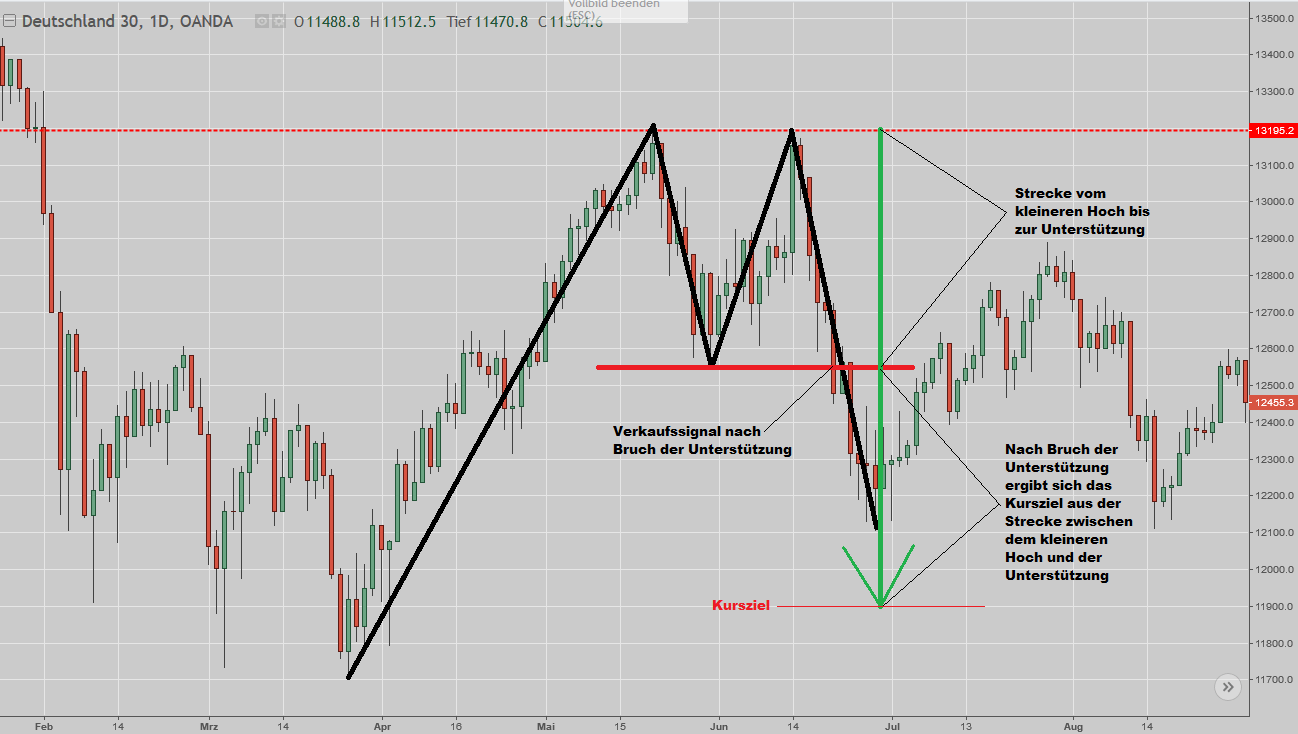

M Trading Pattern - It is also called the double top pattern.

M Trading Pattern - Stop loss orders are essential when trading the m pattern in forex to limit potential losses. Web discover how to identify and capitalize on the m pattern, a powerful chart pattern that can signal potential trend reversals or continuations. Traders are often overwhelmed by emotion. Web what is m pattern in trading? When the pattern appears in an uptrend, it indicates that the price will reverse and start moving downwards.

A double bottom has a 'w' shape and is a signal for a bullish price movement. It is the inverse of the w pattern. Web what is the m trading pattern? Understanding double tops and bottoms When the neckline is breached and the candle closes below the line, traders can start shorting an asset and place a stop loss order above the neckline. A stop loss order should be placed above the. When used correctly, it can provide highly accurate trading signals.

The M and W Pattern YouTube

I have been able to live my life on my own terms thanks to one thing: A novel approach to successful trading using technical analysis and financial astrology [book] Stop loss orders are essential when trading the m pattern in forex to limit potential losses. Web what are the “m” and “w” trading patterns? M.

Double Top (M) Chart Pattern for NSENIFTY by PrasantaP — TradingView India

Web trading arthur merrill's m and w patterns: Web the m chart pattern is a reversal pattern that is bearish. Web one of those patterns is called m formation or double top formation and is widely used by experienced technical traders. It is the inverse of the w pattern. The first peak is formed after.

Was ist ein Doppeltop (MFormation)? TradingTreff

These chart patterns, also known as double top and double bottom patterns, occur when the asset price moves in a similar shape to the letter “w” (double bottom) or “m” (double top). Web 20 8 what is double top pattern? They should be pretty obvious looking too with clear price movements and changes in direction.

The Forex Chart Patterns Guide (with Live Examples) ForexBoat

When used correctly, it can provide highly accurate trading signals. We define what they are, their uses ,types and how they. The first peak is formed after a strong uptrend and then retrace back to the neckline. The pattern is formed by two consecutive downward price swings separated by a brief consolidation period, followed by.

M and W Patterns Forex Strategy Stalking The Market Maker YouTube

Web the big m chart pattern is a double top with tall sides. Web m pattern is a bearish reversal pattern. Web trading the w and m patterns can be a profitable endeavour for both new and experienced traders. The pattern is formed by two consecutive downward price swings separated by a brief consolidation period,.

M pattern and W pattern

Overthinking —> write it down on your journal. This pattern is formed with two peaks above a support level which is also known as the neckline. A double top is a pattern for two. This pattern is created when a key price resistance level on a chart is tested twice with a pullback between the.

M Forex Pattern Fast Scalping Forex Hedge Fund

I have been able to live my life on my own terms thanks to one thing: Overthinking —> write it down on your journal. Stop loss orders are essential when trading the m pattern in forex to limit potential losses. You should make sure you add the “m” and “w” pattern to your trading toolkit.

WHAT IS A TRADING PATTERN? WHICH TRADING PATTERNS EXIST? Bikotrading

I have been able to live my life on my own terms thanks to one thing: Web the m pattern is a technical chart pattern that resembles the letter “m.” it typically occurs during a downtrend and signifies a potential reversal to an uptrend. Always use stop loss orders. When the neckline is breached and.

M and W Patterns Technical Resources

Web the m and w pattern/shapes: A double bottom has a 'w' shape and is a signal for a bullish price movement. This indicates a bearish market movement. When the neckline is breached and the candle closes below the line, traders can start shorting an asset and place a stop loss order above the neckline..

M Forex Pattern Fast Scalping Forex Hedge Fund

It is also called the double top pattern. Web trading the w and m patterns can be a profitable endeavour for both new and experienced traders. Web what is m pattern in trading? This forms an “m” shape on the chart. Web what are the “m” and “w” trading patterns? A double top is a.

M Trading Pattern I have been able to live my life on my own terms thanks to one thing: It is the inverse of the w pattern. Web one of those patterns is called m formation or double top formation and is widely used by experienced technical traders. Always use stop loss orders. The m pattern is another classic reversal formation that signals a potential change from a bullish to a bearish trend.

This Indicates A Bearish Market Movement.

Web a double top has an 'm' shape and indicates a bearish reversal in trend. Web what are m and w patterns in trading, and how do they form? It is also called the double top pattern. Web a pattern is identified by a line connecting common price points, such as closing prices or highs or lows, during a specific period.

Web Discover How To Identify And Capitalize On The M Pattern, A Powerful Chart Pattern That Can Signal Potential Trend Reversals Or Continuations.

Web what is m pattern in trading. Web the big m chart pattern is a double top with tall sides. Web trading the m pattern in forex requires a strong understanding of risk management and technical analysis. Web what is m pattern in trading?

Always Use Stop Loss Orders.

The pattern resembles the letter ‘m’ and indicates a shift from an uptrend to a downtrend. M pattern consists of two tops and a neckline. The first peak is formed after a strong uptrend and then retrace back to the neckline. The pattern is formed by two consecutive downward price swings separated by a brief consolidation period, followed by a breakout above the consolidation level.

These Chart Patterns, Also Known As Double Top And Double Bottom Patterns, Occur When The Asset Price Moves In A Similar Shape To The Letter “W” (Double Bottom) Or “M” (Double Top).

They should be pretty obvious looking too with clear price movements and changes in direction as shown in the example below. A double bottom has a 'w' shape and is a signal for a bullish price movement. When the neckline is breached and the candle closes below the line, traders can start shorting an asset and place a stop loss order above the neckline. A double top chart pattern is a bearish reversal chart pattern that is formed after an uptrend.