Instructions For Form 4136 - Say yes on credit for nontaxable fuel usage;

Instructions For Form 4136 - Web we last updated the credit for federal tax paid on fuels in january 2023, so this is the latest version of form 4136, fully updated for tax year 2022. Substainable aviation fuel (saf) credit. Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels a go to www.irs.gov/form4136 for instructions and the latest. Forms and instructions are subject to omb approval before they can be officially released, so we post drafts of them until. Attach form 4136 to your tax return.

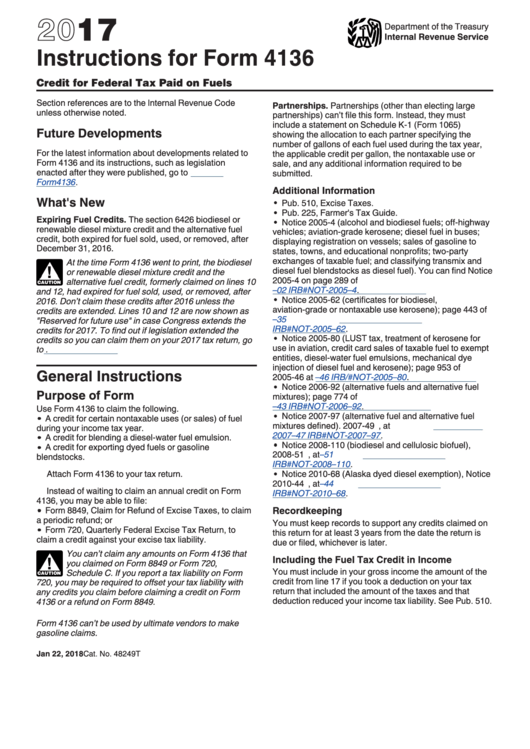

Web go to www.irs.gov/form4136 for instructions and the latest information. Instructions for form 4136, credit for federal tax paid on fuels 2016 inst. The credits available on form 4136 are: Forms and instructions are subject to omb approval before they can be officially released, so we post drafts of them until. Web for instructions and the latest information. Web a credit for exporting dyed fuels or gasoline blendstocks. Web to get form 4136 to populate correctly:

IRS Form 4136 Download Fillable PDF or Fill Online Credit for Federal

Say yes on credit for nontaxable fuel usage; Web form and the final revision of the form. 23 name (as shown on your income tax return). Web 16 rows how to claim the credit. Web information about form 4136, credit for federal tax paid on fuels, including recent updates, related forms and instructions on how.

Instructions For Form 4136 2005 printable pdf download

Instructions for form 4136, credit for federal tax paid on fuels 2016 inst. You can download or print. The alternative fuel a credit for. Credit for certain nontaxable uses (or sales) of fuel during your income tax year. Forms and instructions are subject to omb approval before they can be officially released, so we post.

ads/responsive.txt

Web for instructions and the latest information. Web information about form 4136, credit for federal tax paid on fuels, including recent updates, related forms and instructions on how to file. Web we last updated the credit for federal tax paid on fuels in january 2023, so this is the latest version of form 4136, fully.

Instructions For Form 4136 Credit For Federal Tax Paid On Fuels

Web 16 rows how to claim the credit. Type form 4136 in search in the upper right; The biodiesel or renewable diesel mixture credit. 23 name (as shown on your income tax return) taxpayer identification. Instead of waiting to claim an annual credit on form 4136, you may be able to file: You can download.

Form 4136Credit for Federal Tax Paid on Fuel

Attach form 4136 to your tax return. Complete, edit or print tax forms instantly. Web go to www.irs.gov/form4136 for instructions and the latest information. Any alternative fuel credit must first be claimed on form 720, schedule. 23 name (as shown on your income tax return). The biodiesel or renewable diesel mixture credit. Instructions for form.

IRS Form 4136 Download Fillable PDF or Fill Online Credit for Federal

Attach form 4136 to your tax return. The biodiesel or renewable diesel mixture credit. Forms and instructions are subject to omb approval before they can be officially released, so we post drafts of them until. Get ready for tax season deadlines by completing any required tax forms today. Web form 4136 department of the treasury.

Download Instructions for IRS Form 4136 Credit for Federal Tax Paid on

23 name (as shown on your income tax return) taxpayer identification. Web general instructions purpose of form use form 4136 to claim the following. Complete, edit or print tax forms instantly. Any alternative fuel credit must first be claimed on form 720, schedule. Substainable aviation fuel (saf) credit. Instead of waiting to claim an annual.

Form 4136 Fill out & sign online DocHub

If you report a tax liability on form 720, you may be required to offset your tax liability with any credits you claim before claiming a credit on form 4136 or a refund on. Web general instructions purpose of form use form 4136 to claim the following. Complete, edit or print tax forms instantly. Forms.

Instructions For Form 4136 Credit For Federal Tax Paid On Fuels

The alternative fuel a credit for. The biodiesel or renewable diesel mixture credit. Credit for certain nontaxable uses (or sales) of fuel during your income tax year. Web for instructions and the latest information. If you report a tax liability on form 720, you may be required to offset your tax liability with any credits.

Fillable Credit For Federal Tax Paid On Fuels Irs 4136 printable pdf

Click jump to form 4136; Web information about form 4136, credit for federal tax paid on fuels, including recent updates, related forms and instructions on how to file. Web general instructions purpose of form use form 4136 to claim the following. Web attach form 4136 to your tax return. Ad access irs tax forms. Web.

Instructions For Form 4136 Web information about form 4136, credit for federal tax paid on fuels, including recent updates, related forms and instructions on how to file. Attach form 4136 to your tax return. 23 name (as shown on your income tax return). Any alternative fuel credit must first be claimed on form 720, schedule. According to the instructions for form 4136:.

Web Attach Form 4136 To Your Tax Return.

Web general instructions purpose of form use form 4136 to claim the following. The alternative fuel a credit for. Web for instructions and the latest information. Instead of waiting to claim an annual credit.

Web Information About Form 4136, Credit For Federal Tax Paid On Fuels, Including Recent Updates, Related Forms And Instructions On How To File.

Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels a go to www.irs.gov/form4136 for instructions and the latest. Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels a go to www.irs.gov/form4136 for instructions and the latest. 23 name (as shown on your income tax return). The biodiesel or renewable diesel mixture credit.

Web A Credit For Exporting Dyed Fuels Or Gasoline Blendstocks.

Web credit for federal tax paid on fuels (form 4136) no longer supported in the program the government taxes gasoline, diesel fuel, kerosene, alternative fuels and some other types. The biodiesel or renewable diesel mixture credit the alternative fuel. Web form and the final revision of the form. Web 16 rows how to claim the credit.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web we last updated the credit for federal tax paid on fuels in january 2023, so this is the latest version of form 4136, fully updated for tax year 2022. The credits available on form 4136 are: Ad register and subscribe now to work on your irs form 4136 & more fillable forms. Instead of waiting to claim an annual credit on form 4136, you may be able to file: