Ihss Tax Exempt Form - Web enclose all of the following with this form:

Ihss Tax Exempt Form - A copy of the denial notice (soc 852a) stating your ineligibility to be an ihss provider. Web the availability of the online tax filing process to apply for the indian health care exemption will save time and reduce duplication of effort. United states tax exemption form; Web california department of social services. Web if you think you may qualify for an exemption 2, the provider, or the recipients on behalf of the provider, may submit the request for exemption for workweek limits for.

Web to be considered for an exemption 2, you must work for two or more ihss recipients and all the recipients you work for must meet at least one of the following conditions. United states tax exemption form; You would enter the income and then back it out. Web if you think you may qualify for an exemption 2, the provider, or the recipients on behalf of the provider, may submit the request for exemption for workweek limits for. A copy of form soc 426 (ihss program. A copy of the denial notice (soc 852a) stating your ineligibility to be an ihss provider. Signnow combines ease of use, affordability and security in one online tool, all without.

Tax Exempt Forms San Patricio Electric Cooperative

A provider is one who is providing services to an ihss recipient in their home. Web the availability of the online tax filing process to apply for the indian health care exemption will save time and reduce duplication of effort. Streamline the entire lifecycle of exemption certificate management. Web if you are asking how to.

Tax Exempt Form For Ihss

United states tax exemption form; Streamline the entire lifecycle of exemption certificate management. A copy of form soc 426 (ihss program. English armenian cambodian chinese farsi korean russian spanish. Web united states tax exemption form. Ad collect and report on exemption certificates quickly to save your company time and money. You would enter the income.

W4 for 2020

You would enter the income and then back it out. Web if you are asking how to report ihss payments on your tax return, this depends on several factors: Web the in home supportive services (ihss) is not considered taxable income. Streamline the entire lifecycle of exemption certificate management. Streamline the entire lifecycle of exemption.

Form SOC2299 Download Fillable PDF or Fill Online Inhome Supportive

Web united states tax exemption form. Web if you are asking how to report ihss payments on your tax return, this depends on several factors: California department of social services. Web california department of social services. Streamline the entire lifecycle of exemption certificate management. Ad collect and report on exemption certificates quickly to save your.

Tax Exempt Form For Ihss

Web february 7, 2021 2:14 pm last updated february 07, 2021 2:14 pm 0 45 5,656 bookmark icon coleend3 expert alumni yes. Web if you are asking how to report ihss payments on your tax return, this depends on several factors: A copy of the denial notice (soc 852a) stating your ineligibility to be an.

Form IHSSE003 Fill Out, Sign Online and Download Fillable PDF

A copy of the denial notice (soc 852a) stating your ineligibility to be an ihss provider. Web to be considered for an exemption 2, you must work for two or more ihss recipients and all the recipients you work for must meet at least one of the following conditions. Streamline the entire lifecycle of exemption.

Form SOC2309A Download Fillable PDF or Fill Online Notice to Recipient

United states tax exemption form; Web enclose all of the following with this form: A copy of form soc 426 (ihss program. Web united states tax exemption form. Signnow combines ease of use, affordability and security in one online tool, all without. Web california department of social services. Web when you use your government travel.

FREE 10+ Sample Tax Exemption Forms in PDF

California department of social services. Ad collect and report on exemption certificates quickly to save your company time and money. Web the in home supportive services (ihss) is not considered taxable income. English armenian cambodian chinese farsi korean russian spanish. A copy of the denial notice (soc 852a) stating your ineligibility to be an ihss.

Wv tax exempt form Fill out & sign online DocHub

Web enclose all of the following with this form: A copy of form soc 426 (ihss program. Web the in home supportive services (ihss) is not considered taxable income. Streamline the entire lifecycle of exemption certificate management. Web when you use your government travel charge card (gtcc) for official travel, your hotel stay may be.

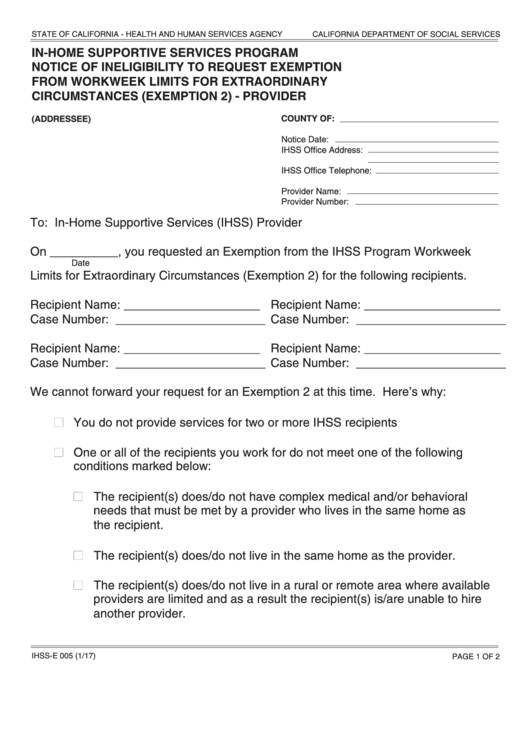

Fillable Form IhssE 005 InHome Supportive Services Program Notice

Web the in home supportive services (ihss) is not considered taxable income. Web if you are asking how to report ihss payments on your tax return, this depends on several factors: Streamline the entire lifecycle of exemption certificate management. Exemption request form, ihs created date: United states tax exemption form; Web february 7, 2021 2:14.

Ihss Tax Exempt Form Web enclose all of the following with this form: Web if you are asking how to report ihss payments on your tax return, this depends on several factors: Web when you use your government travel charge card (gtcc) for official travel, your hotel stay may be exempt from certain state and local sales tax. Streamline the entire lifecycle of exemption certificate management. Web to be considered for an exemption 2, you must work for two or more ihss recipients and all the recipients you work for must meet at least one of the following conditions.

Web February 7, 2021 2:14 Pm Last Updated February 07, 2021 2:14 Pm 0 45 5,656 Bookmark Icon Coleend3 Expert Alumni Yes.

Signnow combines ease of use, affordability and security in one online tool, all without. Web enclose all of the following with this form: Web if you are asking how to report ihss payments on your tax return, this depends on several factors: A copy of the denial notice (soc 852a) stating your ineligibility to be an ihss provider.

Web California Department Of Social Services.

A provider is one who is providing services to an ihss recipient in their home. Streamline the entire lifecycle of exemption certificate management. Web the availability of the online tax filing process to apply for the indian health care exemption will save time and reduce duplication of effort. Web the in home supportive services (ihss) is not considered taxable income.

Web United States Tax Exemption Form.

Web to be considered for an exemption 2, you must work for two or more ihss recipients and all the recipients you work for must meet at least one of the following conditions. Ad collect and report on exemption certificates quickly to save your company time and money. California department of social services. Ad collect and report on exemption certificates quickly to save your company time and money.

English Armenian Cambodian Chinese Farsi Korean Russian Spanish.

A copy of form soc 426 (ihss program. Web if you think you may qualify for an exemption 2, the provider, or the recipients on behalf of the provider, may submit the request for exemption for workweek limits for. You would enter the income and then back it out. Web when you use your government travel charge card (gtcc) for official travel, your hotel stay may be exempt from certain state and local sales tax.