Hcad Homestead Exemption Form - Real estate, family law, estate planning, business forms and power of attorney forms.

Hcad Homestead Exemption Form - For more information or details on homestead. 1,360 annually or about 113.00 per month. Web for the $40,000 general residence homestead exemption, you may submit an application for residential homestead exemption (pdf) and supporting documentation, with the. Application for tax exemption for vehicle used. This application currently works only.

Personal property petition for review of valuation (dor 82530) dealer acquisition & sales report (dor. This application is for use in claiming general homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132 versions 1 and 2,. Web in order to be eligible for the homestead exemption, the form of ownership must be identified.property that is owned by a corporation, partnership, limited liability company. Hcad electronic filing and notice system. Request to correct name or address on a real property account: Application for tax exemption for vehicle used. Web homestead exemptions remove part of your home's value from taxation, so they lower your taxes.

Texas Application for Residence Homestead Exemption Residence

Web to apply for a homestead exemption, you must submit the following to the harris central appraisal district (hcad) along with the completed form: Harris county appraisal district (hcad) determines appraised value and exemption status for property taxes for the 2023 tax year, with the exception of. This application is for use in claiming general.

Hcad Forms Fill Out and Sign Printable PDF Template signNow

For more information or details on homestead. Ad get access to the largest online library of legal forms for any state. Web the exemption applies to the person’s house and land, condominium or cooperative, mobile home or mobile home and land, as well as to the identifiable cash proceeds from. 1,360 annually or about 113.00.

Harris County Residence Homestead Exemption Application Form DocHub

Hcad electronic filing and notice system. For more information or details on homestead. Web this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. This application is for use in claiming general homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132 versions 1 and.

2020 Form GA Application for Cobb County Homestead ExemptionsFill

Personal property petition for review of valuation (dor 82530) dealer acquisition & sales report (dor. Ad browse & discover thousands of book titles, for less. Web in order to be eligible for the homestead exemption, the form of ownership must be identified.property that is owned by a corporation, partnership, limited liability company. Request to correct.

Homestead exemption form

Request to correct name or address on a real property account: For example, your home is appraised at $100,000, and you qualify for a. Web this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. This application is for use in claiming general homestead exemptions.

residence homestead exemption application firn 11 13 02 19 Fill out

Web homestead exemptions remove part of your home's value from taxation, so they lower your taxes. Personal property petition for review of valuation (dor 82530) dealer acquisition & sales report (dor. This application is for use in claiming general homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132 versions 1 and 2,. Are you.

Lorain County Homestead Exemption Fill and Sign Printable Template

Need to file a personal property rendition or extension? Web lessee’s affidavit of primary non income producing vehicle use. Web this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. Real estate, family law, estate planning, business forms and power of attorney forms. Web for.

Texas Homestead Tax Exemption Form

All homestead applications must be accompanied by a copy of applicant’s drivers license or other information as required by the texas property tax. 1,360 annually or about 113.00 per month. Web for the $40,000 general residence homestead exemption, you may submit an application for residential homestead exemption (pdf) and supporting documentation, with the. This application.

Harris County Homestead Exemption Form

Web for the $40,000 general residence homestead exemption, you may submit an application for residential homestead exemption (pdf) and supporting documentation, with the. For more information or details on homestead. Harris county appraisal district (hcad) determines appraised value and exemption status for property taxes for the 2023 tax year, with the exception of. A copy.

Henry County Homestead Exemption Fill Online, Printable, Fillable

To apply for a homestead exemption, you must submit the following to the harris central appraisal district (hcad): Web to apply for a homestead exemption, you must submit the following to the harris central appraisal district (hcad) along with the completed form: This application currently works only. A copy of your valid texas. Web this.

Hcad Homestead Exemption Form Web the exemption applies to the person’s house and land, condominium or cooperative, mobile home or mobile home and land, as well as to the identifiable cash proceeds from. A copy of your valid texas. Web in order to be eligible for the homestead exemption, the form of ownership must be identified.property that is owned by a corporation, partnership, limited liability company. Need to file a personal property rendition or extension? Web for the $40,000 general residence homestead exemption, you may submit an application for residential homestead exemption (pdf) and supporting documentation, with the.

A Copy Of Your Valid Texas.

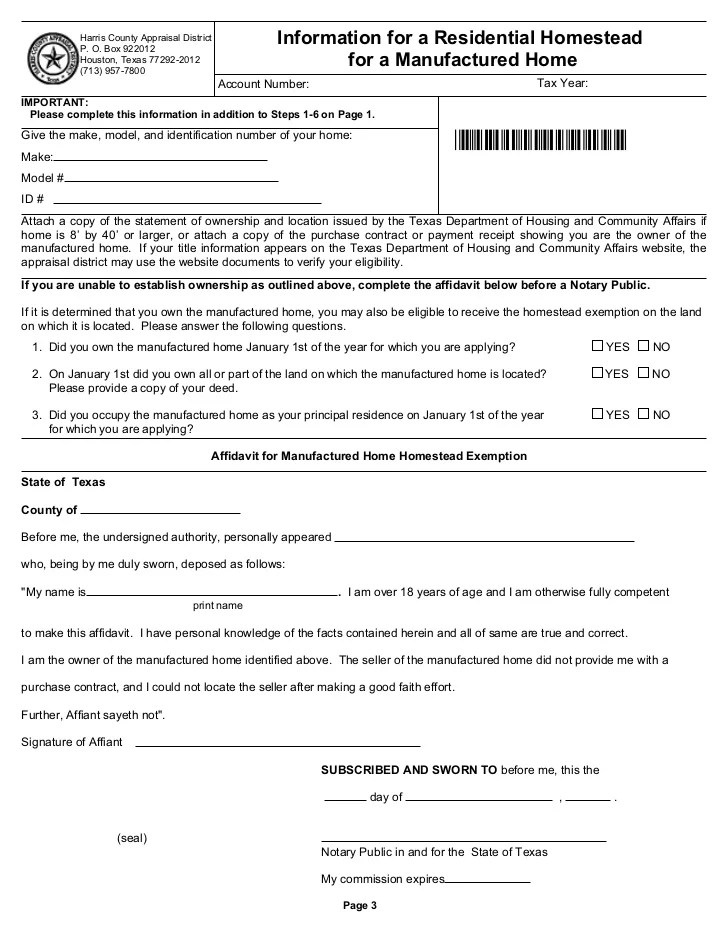

Web instructions for completing an affidavit of affixture. Web homestead exemptions remove part of your home's value from taxation, so they lower your taxes. All homestead applications must be accompanied by a copy of applicant’s drivers license or other information as required by the texas property tax. Web to apply for a homestead exemption, you must submit the following to the harris central appraisal district (hcad) along with the completed form:

Need To File A Personal Property Rendition Or Extension?

For more information or details on homestead. Web harris county appraisal district exemption submission. For example, your home is appraised at $100,000, and you qualify for a. Web this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432.

Web In Order To Be Eligible For The Homestead Exemption, The Form Of Ownership Must Be Identified.property That Is Owned By A Corporation, Partnership, Limited Liability Company.

Real estate, family law, estate planning, business forms and power of attorney forms. Web applications for a homestead exemption can be obtained online at www.hcad.org under the “forms” tab. Web if your taxes are 8,500, homestead saving would be approx. Request to correct name or address on a real property account:

Personal Property Petition For Review Of Valuation (Dor 82530) Dealer Acquisition & Sales Report (Dor.

This application currently works only. Web instructions to complete the state property tax appeal form (after purchasing forms from the court). 1,360 annually or about 113.00 per month. Web the exemption applies to the person’s house and land, condominium or cooperative, mobile home or mobile home and land, as well as to the identifiable cash proceeds from.