Form 940 Annual - Ad get ready for tax season deadlines by completing any required tax forms today.

Form 940 Annual - For example, the 940 for 2020 is due. Web definition irs form 940 is the federal unemployment tax annual report. Web also, refer to form 941, employer's quarterly federal tax return and the instructions for form 941, or form 944, employer's annual federal tax return. The futa helps provide unemployment compensation to workers who have. Web form 940, employer’s annual federal unemployment tax return, is an irs form that employers use to report any futa tax payments they’ve made over the course.

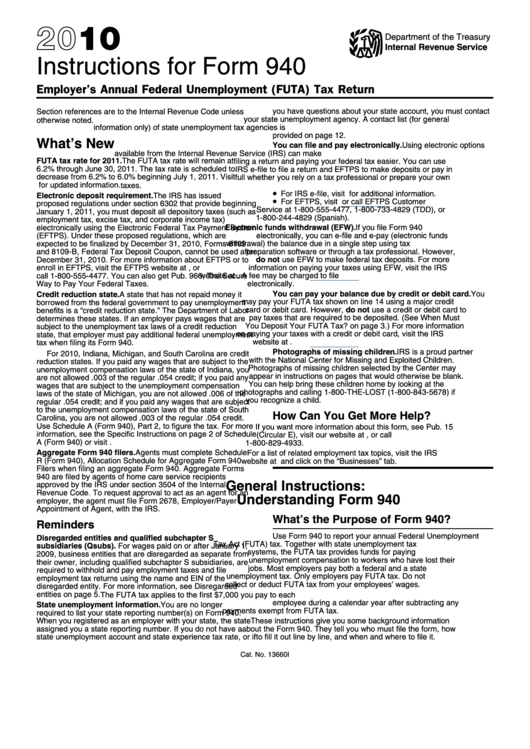

Form 941 is required four times per year, while 940 is. Web 2022 instructions for form 940 employer's annual federal unemployment (futa) tax return department of the treasury internal revenue service section references are to. Complete, edit or print tax forms instantly. This return is for a single state filer, and uses the most current copies of form 940 and. Web • form 940 • form 940 schedule r. Web employment tax forms: Web form 940 is due on jan.

SSA POMS RM 01103.044 Form 940, Employer's Annual Federal

Web form 941 is the employer’s quarterly federal tax return, while form 940 is the annual employer tax report. If the amount of federal unemployment tax due for the year has been paid, the form 940 due date is. Web the draft of form 940 schedule a indicates that california, connecticut, illinois, new york, and.

Form 940 Employer's Annual Federal Unemployment (FUTA) Tax Return

Web definition irs form 940 is the federal unemployment tax annual report. It’s based on the federal. Top beginning with the 2006 tax year, the redesigned form 940 replaces previous. Web form 940 covers a standard calendar year, and the form and payment are due annually by january 31 for the prior year. Web it’s.

Instructions For Form 940 Employer'S Annual Federal Unemployment

Top beginning with the 2006 tax year, the redesigned form 940 replaces previous. The futa helps provide unemployment compensation to workers who have. Form 941 is required four times per year, while 940 is. Web employer’s annual federal unemployment (futa) tax return department of the treasury — internal revenue service 850113 omb no. Use form.

Fillable Form 940 Employer'S Annual Federal Unemployment (Futa) Tax

Web 2022 instructions for form 940 employer's annual federal unemployment (futa) tax return department of the treasury internal revenue service section references are to. There may be earlier payment deadlines,. Web also, refer to form 941, employer's quarterly federal tax return and the instructions for form 941, or form 944, employer's annual federal tax return..

SSA POMS RM 01103.044 Form 940, Employer's Annual Federal

Web 2022 instructions for form 940 employer's annual federal unemployment (futa) tax return department of the treasury internal revenue service section references are to. Ad edit, fill, sign 940 2017 federal & more fillable forms. For example, the 940 for 2020 is due. Web form 940 is used to report the employer’s annual federal unemployment.

Instructions For Form 940 Employer'S Annual Federal Unemployment

Together with state unemployment tax systems, the futa tax provides funds for paying. Web up to $32 cash back form 940 is an annual tax form that documents your company’s contributions to federal unemployment taxes. Web filing form 940 with the irs. Web form 941 is the employer’s quarterly federal tax return, while form 940.

Instructions For Form 940Ez Employer'S Annual Federal Unemployment

Web filing form 940 with the irs. Web up to $32 cash back form 940 is an annual tax form that documents your company’s contributions to federal unemployment taxes. Web form 940 covers a standard calendar year, and the form and payment are due annually by january 31 for the prior year. Top beginning with.

form 940 2019 2020 Fill Online, Printable, Fillable Blank form

Web the draft of form 940 schedule a indicates that california, connecticut, illinois, new york, and the virgin islands will still be in credit reduction status for tax year. Use form 940 to report your annual federal unemployment tax act (futa) tax. There may be earlier payment deadlines,. Web employment tax forms: The futa helps.

Form 940 Employer's Annual Federal Unemployment (FUTA) Tax Return

Irs form 940 is due on january 31 of the year after the year of the report information. Web up to $32 cash back form 940 is an annual tax form that documents your company’s contributions to federal unemployment taxes. It’s based on the federal. The futa tax return differs from other employment. Web 2022.

Form 940 Instructions 2019 Fill Out and Sign Printable PDF Template

Web the draft of form 940 schedule a indicates that california, connecticut, illinois, new york, and the virgin islands will still be in credit reduction status for tax year. Web filing form 940 with the irs. Web up to $32 cash back form 940 is an annual tax form that documents your company’s contributions to.

Form 940 Annual Top beginning with the 2006 tax year, the redesigned form 940 replaces previous. Web about form 940, employer's annual federal unemployment (futa) tax return. Web 2022 instructions for form 940 employer's annual federal unemployment (futa) tax return department of the treasury internal revenue service section references are to. Use form 940 to report your annual federal unemployment tax act (futa) tax. The futa tax return differs from other employment.

Web It’s About Time To Complete Form 940, Employer’s Annual Federal Unemployment (Futa) Tax Return.

Together with state unemployment tax systems, the futa tax provides funds for paying. Employers must report and pay unemployment taxes to the irs for their employees. Ad get ready for tax season deadlines by completing any required tax forms today. Irs form 940 is due on january 31 of the year after the year of the report information.

Web Filing Form 940 With The Irs.

The futa tax return differs from other employment. Web form 940 is used to report the employer’s annual federal unemployment tax (futa). Web definition irs form 940 is the federal unemployment tax annual report. Use form 940 to report your annual federal unemployment tax act (futa) tax.

If The Amount Of Federal Unemployment Tax Due For The Year Has Been Paid, The Form 940 Due Date Is.

It’s based on the federal. Web • form 940 • form 940 schedule r. This return is for a single state filer, and uses the most current copies of form 940 and. Web form 940 is due on jan.

Web Also, Refer To Form 941, Employer's Quarterly Federal Tax Return And The Instructions For Form 941, Or Form 944, Employer's Annual Federal Tax Return.

Web about form 940, employer's annual federal unemployment (futa) tax return. Web form 940 covers a standard calendar year, and the form and payment are due annually by january 31 for the prior year. The futa helps provide unemployment compensation to workers who have. 31 each year for the previous year.