Form 4972 Irs - The following choices are available.

Form 4972 Irs - Send filled & signed form or save. It allows beneficiaries to receive their entire benefit in. Web form 4972 is an irs form with stipulated terms and conditions that is filled out to reduce the taxes that may be incurred on huge distribution amounts. See capital gain election, later. Web who can use form 4972.

Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains. The file is in adobe. Open form follow the instructions. Use this form to figure the. The following choices are available. Send filled & signed form or save. Complete, edit or print tax forms instantly.

2019 IRS Form 4972 Fill Out Digital PDF Sample

It allows beneficiaries to receive their entire benefit in. Send filled & signed form or save. Web the amounts needed to complete form 4972. The following choices are available. My brother died in 2019. Web form 4972 part i. Easily sign the form with your finger. Download or email irs 4972 & more fillable forms,.

IRS Form 4972 Download Fillable PDF or Fill Online Tax on LumpSum

Complete, edit or print tax forms instantly. Send filled & signed form or save. Open form follow the instructions. I was the beneficiary of the pension plan. The form is used to take advantage of special grandfathered taxation options. See capital gain election, later. You can download or print current. Ad pdffiller.com has been visited.

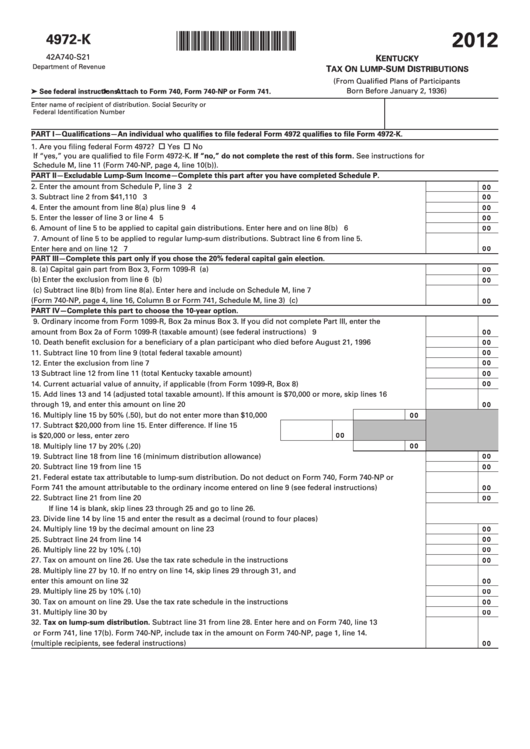

Fillable Form 4972K Kentucky Tax On LumpSum Distributions 2012

Web who can use form 4972. He had a pension plan. Send filled & signed form or save. You can download or print current. To see if you qualify, you must first determine if your distribution is a. Web the amounts needed to complete form 4972. Ad pdffiller.com has been visited by 1m+ users in.

IRS Form 4972A Guide to Tax on LumpSum Distributions

If you're unsure whether you qualify to file form 4972, part i of the form walks you through a series of five questions to determine your. The following choices are available. Use this form to figure the. The following choices are available. The form is used to take advantage of special grandfathered taxation options. I.

Form SC4972 Download Printable PDF or Fill Online Tax on LumpSum

It allows beneficiaries to receive their entire benefit in. Web the amounts needed to complete form 4972. Easily sign the form with your finger. You can download or print current. If you're unsure whether you qualify to file form 4972, part i of the form walks you through a series of five questions to determine.

2018 8812 form Fill out & sign online DocHub

The following choices are available. Send filled & signed form or save. Web who can use form 4972. Use this form to figure the. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains. Web form 4972 is an irs form with stipulated terms.

Kentucky Tax On LumpSum Distributions (Form 4972K 1999) printable pdf

The following choices are available. The following choices are available. Web form 4972 is an irs form with stipulated terms and conditions that is filled out to reduce the taxes that may be incurred on huge distribution amounts. My brother died in 2019. Ad pdffiller.com has been visited by 1m+ users in the past month.

Form 4972 Turbotax Fill Out and Sign Printable PDF Template signNow

He had a pension plan. Ad pdffiller.com has been visited by 1m+ users in the past month Web the amounts needed to complete form 4972. The form is used to take advantage of special grandfathered taxation options. You can download or print current. I was the beneficiary of the pension plan. Send filled & signed.

Tax on LumpSum Distributions

Easily sign the form with your finger. You can download or print current. Web form 4972 part i. It allows beneficiaries to receive their entire benefit in. To claim these benefits, you must file irs. Use this form to figure the. The following choices are available. The following choices are available.

Form 4972 Tax on LumpSum Distributions (2015) Free Download

The file is in adobe. Easily sign the form with your finger. I was the beneficiary of the pension plan. Open form follow the instructions. Web what is irs form 4972 used for? Web the amounts needed to complete form 4972. If you're unsure whether you qualify to file form 4972, part i of the.

Form 4972 Irs The following choices are available. Web the amounts needed to complete form 4972. Web what is irs form 4972 used for? To see if you qualify, you must first determine if your distribution is a. The file is in adobe.

The Following Choices Are Available.

It allows beneficiaries to receive their entire benefit in. Ad pdffiller.com has been visited by 1m+ users in the past month My brother died in 2019. Use this form to figure the.

He Had A Pension Plan.

Complete, edit or print tax forms instantly. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains. The following choices are available. Web the amounts needed to complete form 4972.

I Was The Beneficiary Of The Pension Plan.

Open form follow the instructions. Web form 4972 is an irs form with stipulated terms and conditions that is filled out to reduce the taxes that may be incurred on huge distribution amounts. To see if you qualify, you must first determine if your distribution is a. Web form 4972 part i.

Web Who Can Use Form 4972.

You can download or print current. Send filled & signed form or save. The file is in adobe. Web what is irs form 4972 used for?