Form 3800 Instructions - Free, fast, full version (2023) available!

Form 3800 Instructions - Web instead, they can report this credit directly on form 3800, general business credit. Pdffiller allows users to edit, sign, fill & share all type of documents online. For instructions and the latest information. Web developments related to form 3800 and its instructions, such as legislation enacted after they were published, go to irs.gov/form3800. Income tax return for cooperative associations, schedule j, line 5c.

The investment credit is also made up of several different credits. Web for paperwork reduction act notice, see separate instructions. Edit, sign and save health care condition cer form. Form 3800, “general business credit,” is an irs form used to record tax credits for businesses. Web when carrying a credit forward or back and the taxpayer's filing status changed between the two years, the allowable credit must be calculated differently. Eligible small businesses, enter your research credit on line 4i. For instructions and the latest information.

Form 3800 2022 2023

2 part ii allowable credit (continued) note: Web when carrying a credit forward or back and the taxpayer's filing status changed between the two years, the allowable credit must be calculated differently. Web instructions for form 3800 general business credit department of the treasury internal revenue service section references are to the internal revenue code..

Instructions For Form 3800 General Business Credit 2007 printable

3800 (2020) form 3800 (2020) page. See the instructions for form 6765 for more details. General instructions partnerships and s. Web below are solutions to frequently asked questions about entering form 3800, general business credits. The investment credit is also made up of several different credits. Department of the treasury internal revenue service. Income tax.

Instructions For Form 3800 General Business Credit Internal Revenue

Where do i enter carryovers from other years? Eligible small businesses, enter your research credit on line 4i. Form 3800, “general business credit,” is an irs form used to record tax credits for businesses. Web below are solutions to frequently asked questions about entering form 3800, general business credits. Web form 3800, general business credit,.

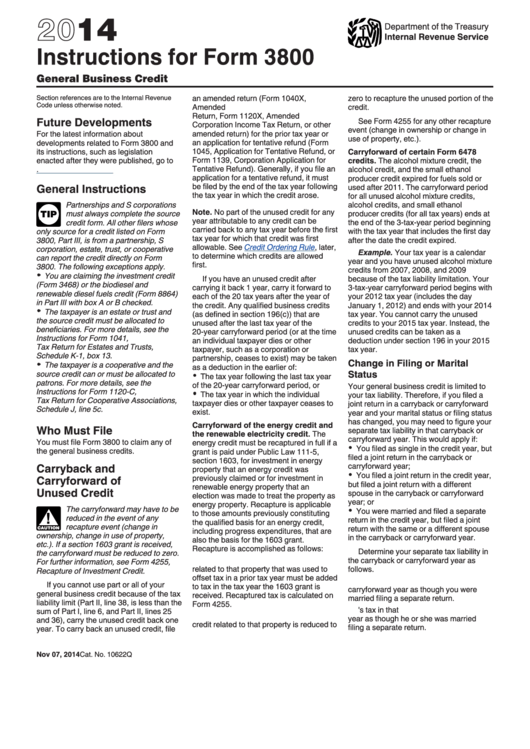

Instructions For Form 3800 2014 printable pdf download

What’s new the enhanced oil recovery. Web below are solutions to frequently asked questions about entering form 3800, general business credits. Web the general business credit (form 3800) is made up of many other credits, like: For instructions and the latest information. Web up to 10% cash back the irs recently released a major redesign.

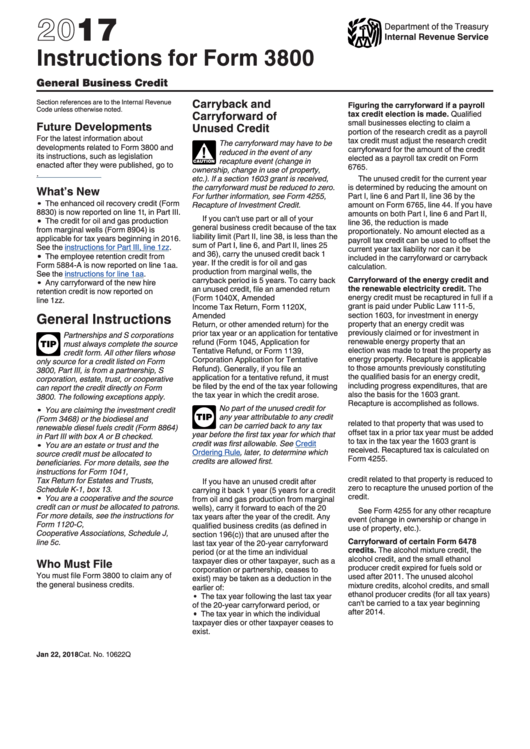

Instructions For Form 3800 General Business Credit 2017 printable

Web when carrying a credit forward or back and the taxpayer's filing status changed between the two years, the allowable credit must be calculated differently. As a beginning tax filer, filing form 3800 can be daunting. Pdffiller allows users to edit, sign, fill & share all type of documents online. Edit, sign and save health.

Form 3800 General Business Credit (2014) Free Download

Tip who must file you must file form. Knowing the requirements and instructions associated with form 3800 is essential for filing your. Web what is form 3800? 3800 (2020) form 3800 (2020) page. Web a qualified small business must complete form 3800 before completing section d of form 6765 if the payroll tax credit is.

CA Form 3800 20202022 Fill and Sign Printable Template Online US

Web form 3800, general business credit, is an irs form used to record tax credits for businesses. Web when carrying a credit forward or back and the taxpayer's filing status changed between the two years, the allowable credit must be calculated differently. Web developments related to form 3800 and its instructions, such as legislation enacted.

Instructions For Form 3800 2016 printable pdf download

Web instead, they can report this credit directly on form 3800, general business credit. Income tax return for cooperative associations, schedule j, line 5c. Web a qualified small business must complete form 3800 before completing section d of form 6765 if the payroll tax credit is being claimed. Eligible small businesses, enter your research credit.

Download Instructions for IRS Form 3800 General Business Credit PDF

The investment credit is also made up of several different credits. Web a qualified small business must complete form 3800 before completing section d of form 6765 if the payroll tax credit is being claimed. Pdffiller allows users to edit, sign, fill & share all type of documents online. Web instead, they can report this.

IRS Form 3800 Instructions General Business Credit

#didyouknow you can use tax credits to lower. Income tax return for cooperative associations, schedule j, line 5c. Web developments related to form 3800 and its instructions, such as legislation enacted after they were published, go to irs.gov/form3800. Web developments related to form 3800 and its instructions, such as legislation enacted after they were published,.

Form 3800 Instructions Web developments related to form 3800 and its instructions, such as legislation enacted after they were published, go to irs.gov/form3800. The investment credit is also made up of several different credits. Where do i enter carryovers from other years? Free, fast, full version (2023) available! Department of the treasury internal revenue service.

3800 (2020) Form 3800 (2020) Page.

Pdffiller allows users to edit, sign, fill & share all type of documents online. Income tax return for cooperative associations, schedule j, line 5c. Web what is form 3800? Where do i enter carryovers from other years?

See The Instructions For Form 6765 For More Details.

Web instructions for form 3800 general business credit department of the treasury internal revenue service section references are to the internal revenue code. Web the general business credit (form 3800) is made up of many other credits, like: For instructions and the latest information. Department of the treasury internal revenue service.

Knowing The Requirements And Instructions Associated With Form 3800 Is Essential For Filing Your.

Free, fast, full version (2023) available! As a beginning tax filer, filing form 3800 can be daunting. #didyouknow you can use tax credits to lower a business's tax. These drafts incorporate the extensive.

2 Part Ii Allowable Credit (Continued) Note:

Edit, sign and save health care condition cer form. General instructions partnerships and s. Web form 3800, general business credit, is an irs form used to record tax credits for businesses. Web below are solutions to frequently asked questions about entering form 3800, general business credits.