Form 2220 Instructions - Get ready for tax season deadlines by completing any required tax forms today.

Form 2220 Instructions - Web the irs also indicated that it expects to make changes to the instructions to form 2220, underpayment of estimated tax by corporations, to clarify that no addition to tax will be. Web form 2210 (or form 2220 for corporations) will help you determine the penalty amount. Form 2120 is used by persons. The internal revenue service requires that a taxpayer use federal form 2220 if the taxpayer seeks relief from the interest due on their underpayment of. Web video instructions and help with filling out and completing 2020 2220.

If form 2220 is completed, enter. How to use form 2220; Web for the latest information about developments affecting form 2220 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2220. Underpayment of estimated tax by corporations. Attach to the corporation’s tax return. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Do your truck tax online & have it efiled to the irs!

Form 2220 Instructions 2018 Fill Out and Sign Printable PDF Template

Who must pay the underpayment penalty. Get ready for tax season deadlines by completing any required tax forms today. If form 2220 is completed, enter. How to use form 2220; Easy, fast, secure & free to try. Web information about form 2120, multiple support declaration, including recent updates, related forms and instructions on how to.

Instructions For Form 2220 Underpayment Of Estimated Tax By

Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Web form 2210 (or form 2220 for corporations) will help you determine the penalty amount. Web dd form 2220 will be used to identify registered povs on army, navy, air force, marine corps, and dla installations or facilities. The internal.

Download Instructions for IRS Form 2220 Underpayment of Estimated Tax

Do your truck tax online & have it efiled to the irs! Easy, fast, secure & free to try. Web video instructions and help with filling out and completing 2020 2220. Web for the latest information about developments affecting form 2220 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2220..

Instructions For Form 2220 Underpayment Of Estimated Tax By

Ad access irs tax forms. The internal revenue service requires that a taxpayer use federal form 2220 if the taxpayer seeks relief from the interest due on their underpayment of. Easy, fast, secure & free to try. Dc law requires any business that expects its dc franchise tax. Who must pay the underpayment penalty. Web.

IRS Form 2220 Instructions Estimated Corporate Tax

Transform an online template into an accurately completed form 2220 instructions 2022 in a matter of. Do your truck tax online & have it efiled to the irs! Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Ad access irs tax forms. Underpayment of estimated tax by corporations. Attach.

Form Il2220 Instructions Illinois Department Of Revenue 2013

Web video instructions and help with filling out and completing 2020 2220. Underpayment of estimated tax by corporations. Attach to the corporation’s tax return. Web for the latest information about developments affecting form 2220 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2220. Ad access irs tax forms. Enter estimated.

Fillable Form 2220K Underpayment And Late Payment Of Estimated

Easy, fast, secure & free to try. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Web for the latest information about developments affecting form 2220 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2220. Underpayment of estimated tax by corporations. Transform an online.

How to avoid a penalty using Form 2220?

Web for the latest information about developments affecting form 2220 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2220. Web form 2220 department of the treasury internal revenue service underpayment of estimated tax by corporations attach to the corporation’s tax return. Web information about form 2120, multiple support declaration, including.

IRS Form 2220 Instructions Estimated Corporate Tax

The internal revenue service requires that a taxpayer use federal form 2220 if the taxpayer seeks relief from the interest due on their underpayment of. Complete, edit or print tax forms instantly. This form contains both a short. Web use form 2220, underpayment of estimated tax by corporations, to see if the corporation owes a.

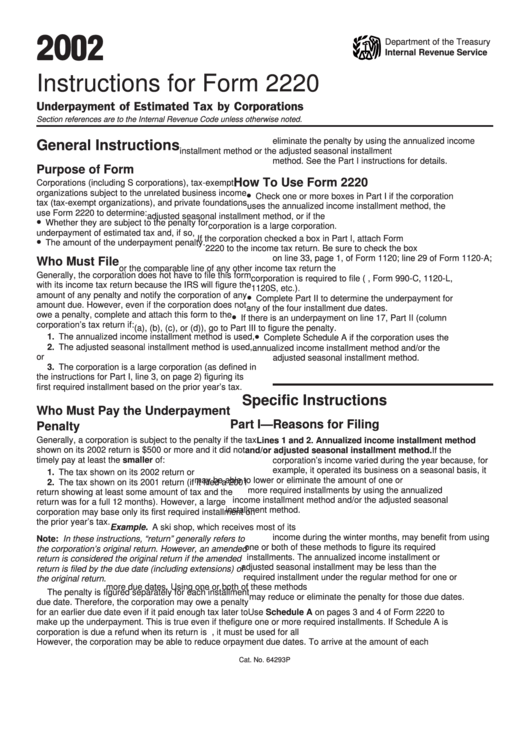

Instructions For Form 2220 2002 printable pdf download

Form 2120 is used by persons. Web if you file your return by april 17, 2023, no interest will be charged on the penalty if you pay the penalty by the date shown on the bill. Department of the treasury internal revenue service. Web for the latest information about developments affecting form 2220 and its.

Form 2220 Instructions Web information about form 2120, multiple support declaration, including recent updates, related forms and instructions on how to file. Web video instructions and help with filling out and completing 2020 2220. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Web for the latest information about developments affecting form 2220 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2220. Attach to the corporation’s tax return.

Web If You File Your Return By April 17, 2023, No Interest Will Be Charged On The Penalty If You Pay The Penalty By The Date Shown On The Bill.

How to use form 2220; Web the irs also indicated that it expects to make changes to the instructions to form 2220, underpayment of estimated tax by corporations, to clarify that no addition to tax will be. Web for the latest information about developments affecting form 2220 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2220. If form 2220 is completed, enter.

Web Information About Form 2120, Multiple Support Declaration, Including Recent Updates, Related Forms And Instructions On How To File.

Web corporations may have to complete irs form 2220 to determine if they have paid enough tax to avoid paying a penalty when they file their tax return. Web form 2220 department of the treasury internal revenue service underpayment of estimated tax by corporations attach to the corporation’s tax return. Web form 2210 (or form 2220 for corporations) will help you determine the penalty amount. Easy, fast, secure & free to try.

Web Dd Form 2220 Will Be Used To Identify Registered Povs On Army, Navy, Air Force, Marine Corps, And Dla Installations Or Facilities.

Web video instructions and help with filling out and completing 2020 2220. This form contains both a short. The form is produced in single copy for. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs.

The Internal Revenue Service Requires That A Taxpayer Use Federal Form 2220 If The Taxpayer Seeks Relief From The Interest Due On Their Underpayment Of.

You should figure out the amount of tax you have underpaid. Get ready for tax season deadlines by completing any required tax forms today. Enter estimated tax payments you made by the 15th day of the 4th month of. Department of the treasury internal revenue service.