Calendar Spread Calculator - Web anytime you adjust a position, or roll a position to a new expiration cycle, it can be extremely confusing on how to figure out your profit or loss.

Calendar Spread Calculator - Web to calculate our total return on the calendar spread, we must first compute the cost to open the trade. Web calculate potential profit, max loss, chance of profit, and more for calendar call spread options and over 50 more strategies. Calendar spread calculator shows projected profit and loss over time. Web calendar put spread calculator. Web april 27, 2020 •.

Web to create a long calendar spread, follow these steps: Web anytime you adjust a position, or roll a position to a new expiration cycle, it can be extremely confusing on how to figure out your profit or loss. If our calendar spread was. Choose an underlying asset you know and believe will experience relatively stable. The calendar spread is different from a. Web click the calculate button above to see estimates. Web april 27, 2020 •.

Pin on Calendar Spreads Options

Web the negative impact of a decline in volatility on the profit potential for our example calendar spread trade appears in figure 3. A calendar spread involves buying long term call. Web click the calculate button above to see estimates. Web to create a long calendar spread, follow these steps: Web a calendar spread, also.

Calendar Spreads

If our calendar spread was. Web a calendar spread is a strategy used in options and futures trading: The calendar put spread calculator can be used to chart theoretical profit and loss (p&l) for a calendar put position. A calendar spread involves buying long term call. Web a calendar spread, also known as a horizontal.

Double Calendar Spreads Ultimate Guide With Examples

Web click the calculate button above to see estimates. Choose an underlying asset you know and believe will experience relatively stable. If our calendar spread was. Following this decline in implied. Web calculate potential profit, max loss, chance of profit, and more for calendar call spread options and over 50 more strategies. The calendar spread.

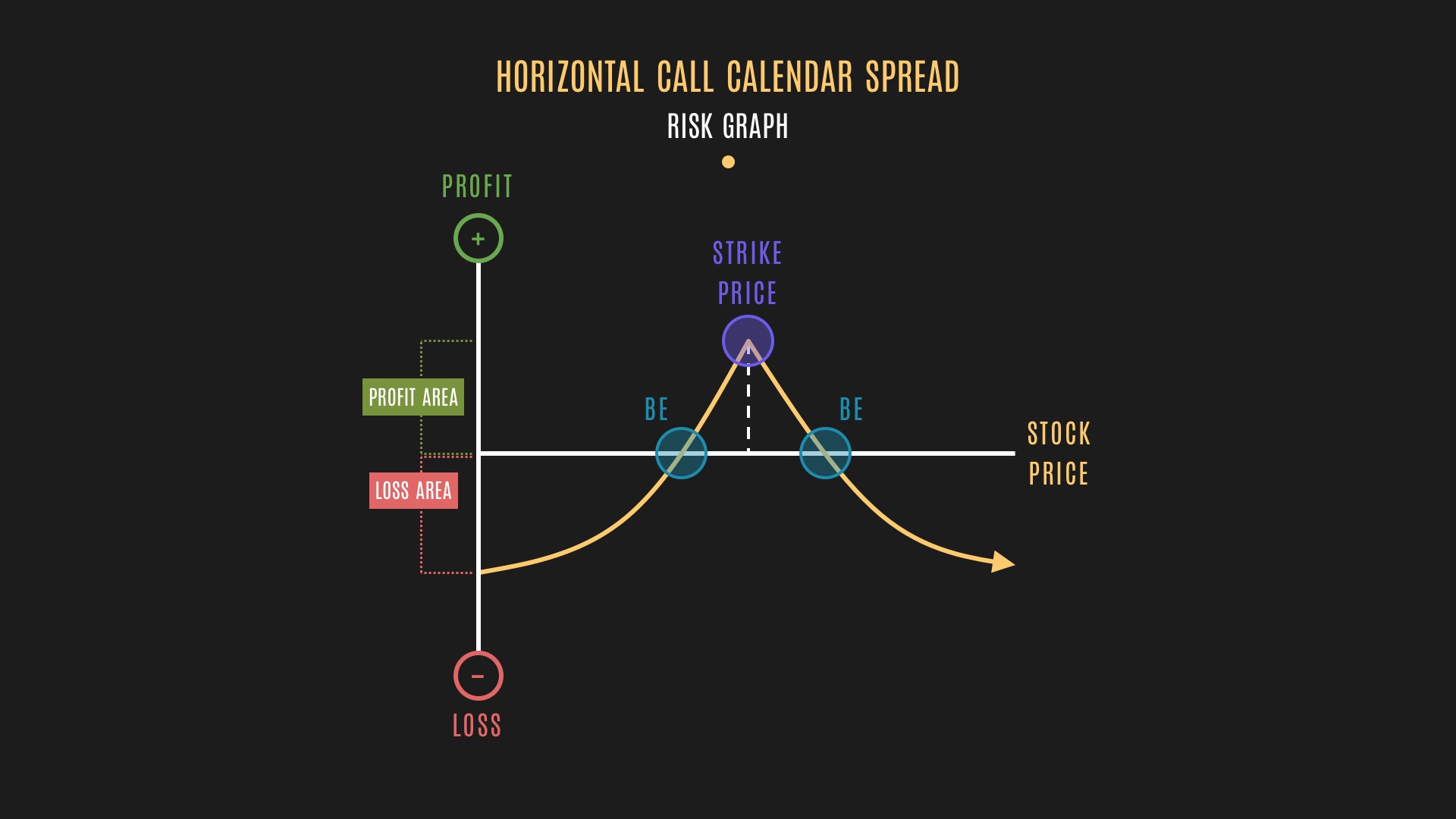

Glossary Definition Horizontal Call Calendar Spread Tackle Trading

We can then calculate the cost to close to trade. A calendar spread involves buying long term call. Web a calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same underlying asset and strike. The calendar put spread calculator can be used to.

Calendar Spread Strategy How To Make Adjustments YouTube

Web april 27, 2020 •. Web calendar put spread calculator. We can then calculate the cost to close to trade. Web anytime you adjust a position, or roll a position to a new expiration cycle, it can be extremely confusing on how to figure out your profit or loss. If our calendar spread was. Calendar.

Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Web the negative impact of a decline in volatility on the profit potential for our example calendar spread trade appears in figure 3. Web calendar put spread calculator. A calendar spread involves buying long term call. Web a calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position.

Calendar Call Spread Calculator

If our calendar spread was. That is, for every net debit of $1 at initiation, you’re hoping to. Following this decline in implied. Web (april 2020) in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a. Web.

Pin on CALENDAR SPREADS OPTIONS

Web april 27, 2020 •. Choose an underlying asset you know and believe will experience relatively stable. We can then calculate the cost to close to trade. Calendar spread calculator shows projected profit and loss over time. Web calendar put spread calculator. Web anytime you adjust a position, or roll a position to a new.

How Calendar Spreads Work (Best Explanation) projectoption

Web click the calculate button above to see estimates. Web (april 2020) in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a. That is, for every net debit of $1 at initiation, you’re hoping to. Calendar spread.

Pin on CALENDAR SPREADS OPTIONS

The date calculator adds or subtracts days,. That is, for every net debit of $1 at initiation, you’re hoping to. Web click the calculate button above to see estimates. Web a calendar spread is a strategy used in options and futures trading: Web anytime you adjust a position, or roll a position to a new.

Calendar Spread Calculator Web to create a long calendar spread, follow these steps: Web a calendar spread is a strategy used in options and futures trading: Web anytime you adjust a position, or roll a position to a new expiration cycle, it can be extremely confusing on how to figure out your profit or loss. Web a calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same underlying asset and strike. Web calendar put spread calculator.

Web To Calculate Our Total Return On The Calendar Spread, We Must First Compute The Cost To Open The Trade.

Following this decline in implied. Web (april 2020) in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a. Web anytime you adjust a position, or roll a position to a new expiration cycle, it can be extremely confusing on how to figure out your profit or loss. Web calculate potential profit, max loss, chance of profit, and more for calendar call spread options and over 50 more strategies.

Choose An Underlying Asset You Know And Believe Will Experience Relatively Stable.

A calendar spread involves buying long term call. Web click the calculate button above to see estimates. The calendar spread is different from a. Web the negative impact of a decline in volatility on the profit potential for our example calendar spread trade appears in figure 3.

Web A Calendar Spread Is A Strategy Used In Options And Futures Trading:

That is, for every net debit of $1 at initiation, you’re hoping to. They can provide a lot of flexibility and variation to your portfolio. The calendar put spread calculator can be used to chart theoretical profit and loss (p&l) for a calendar put position. The date calculator adds or subtracts days,.

Calendar Spreads Are A Fantastic Option Trade As You’re About To Find Out.

Calendar spread calculator shows projected profit and loss over time. Web a calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same underlying asset and strike. If our calendar spread was. We can then calculate the cost to close to trade.

![Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019ad90afc0a18011924af0_3Ui8KuFuRxcjUyFQ2mvscNmGIXALxE0ESnrXkoAAqNejP5Ygrj-dyv3Kfo-1jmOjFg2axgrXs-MriQsNl-6is4rU-lDczPVaDzlttqUjTEJIvT6pRF0GK8qSlYVoNo6r5r07P-gi.png)