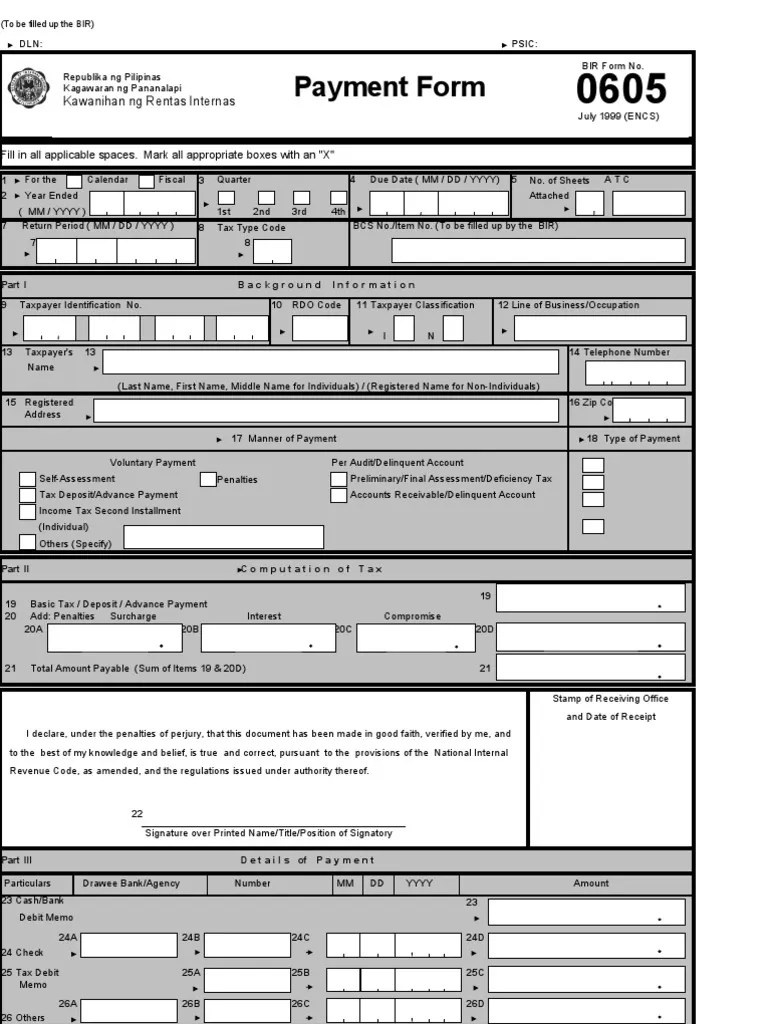

Bir Form 0605 - This form is to be accomplished every time a taxpayer pays taxes and fees which do not require the use of.

Bir Form 0605 - What is the 0605 bir form? This form is to be accomplished every time a taxpayer pays taxes and fees which do not require the use of. Web bir form 0605 is the official payment form. Web 37 rows form no. Open form follow the instructions.

Web view, download and print bir no. This form is to be accomplished every time a taxpayer pays taxes and fees which do not require the use of. 0605 for excise tax purposes. Select general forms and hit next. What is the 0605 bir form? Open form follow the instructions. Easily sign the form with your finger.

BIR FORM 0605 EBOOK DOWNLOAD

Easily sign the form with your finger. From your portal, click on the start return button. To file a bir form 0605 in fast file, follow the steps below: Web up to $3 cash back bir form no. Web list of bir forms. Standard policy and guidelines for the use of bir form no. Web.

bir form 0605 philippin news collections

Web general registration requirements. From your portal, click on the start return button. Easily sign the form with your finger. Web failure to file, pay and display bir form 0605 annual registration fee will result to a compromise penalty of one thousand pesos (p1,000.00), or criminal penalty of. It is used to settle. Payment form.

BIR FORM 0605 [PDF Document]

Kawanihan ng rentas internas payment form september 2003 (encs) 1. Get your bir form 0605 in 3 easy steps. It is used to settle. Web up to $40 cash back bir form 0605 (september 2018) is a payment form used by taxpayers to pay taxes or fees due to the philippine bureau of internal revenue.

illustration on how to fill out the BIR Form 0605 for payment of

Easily sign the form with your finger. 0605 for excise tax purposes. Get your bir form 0605 in 3 easy steps. Web bir form 0605 is a payment form used by taxpayers in the philippines to pay various taxes. Web failure to file, pay and display bir form 0605 annual registration fee will result to.

BIR form 0605 Kaila Sharlene

From your portal, click on the start return button. Web up to $40 cash back bir form 0605 (september 2018) is a payment form used by taxpayers to pay taxes or fees due to the philippine bureau of internal revenue (bir). Web view, download and print bir no. It is used to settle. Open form.

BIR form 0605 Withholding Tax Payments

22 payment form templates are collected for any of your needs. The commissioner of internal revenue has issued rmc no. Web up to $3 cash back bir form no. 03 export or print immediately. Payment form under tax compliance. 0605 for excise tax purposes. Web 37 rows form no. Open form follow the instructions.

BIR Form 0605101 Download

Web 37 rows form no. Web up to $3 cash back bir form no. Get your bir form 0605 in 3 easy steps. Easily sign the form with your finger. Web up to $40 cash back bir form 0605 (september 2018) is a payment form used by taxpayers to pay taxes or fees due to.

How to Fill Out BIR Form 0605 for Annual Registration Fee Months in a

Select general forms and hit next. Web up to $3 cash back bir form no. Learn how to fill it out correctly to avoid penalties. 01 fill and edit template. Open form follow the instructions. From your portal, click on the start return button. Easily sign the form with your finger. Web list of bir.

How To Pay For Your BIR Registration Fee Without Leaving Home

Web general registration requirements. 0605 for excise tax purposes. Web this bir form is to be accomplished every time a taxpayer pays taxes and fees which do not require the use of a tax return such as second installment payment for income tax,. Web up to $40 cash back bir form 0605 (september 2018) is.

From “ghost” freelancer to taxpayer BIR registration for freelance

It is used to settle. Easily sign the form with your finger. Payment form covered by a letter notice: Select general forms and hit next. 22 payment form templates are collected for any of your needs. Web failure to file, pay and display bir form 0605 annual registration fee will result to a compromise penalty.

Bir Form 0605 01 fill and edit template. It is used to settle. The commissioner of internal revenue has issued rmc no. Get your bir form 0605 in 3 easy steps. Web bir form 0605 is the official payment form.

0605 For Excise Tax Purposes.

Payment form covered by a letter notice: Get your bir form 0605 in 3 easy steps. This form is to be accomplished every time a taxpayer pays taxes and fees which do not require the use of. Web 37 rows form no.

Open Form Follow The Instructions.

From your portal, click on the start return button. Web this bir form is to be accomplished every time a taxpayer pays taxes and fees which do not require the use of a tax return such as second installment payment for income tax,. 22 payment form templates are collected for any of your needs. What is the 0605 bir form?

To File A Bir Form 0605 In Fast File, Follow The Steps Below:

The commissioner of internal revenue has issued rmc no. Web (4.8 / 5) 57 votes. Standard policy and guidelines for the use of bir form no. Web bir form 0605 is a payment form used by taxpayers in the philippines to pay various taxes.

Learn How To Fill It Out Correctly To Avoid Penalties.

Web general registration requirements. 03 export or print immediately. § for voluntary payment of taxes, bir. Web failure to file, pay and display bir form 0605 annual registration fee will result to a compromise penalty of one thousand pesos (p1,000.00), or criminal penalty of.

![BIR FORM 0605 [PDF Document]](https://i2.wp.com/cdn.cupdf.com/img/1200x630/reader016/image/20181217/577ccd3a1a28ab9e788bd738.png)